How to cut your household bills

Busy lives make it tough to keep track of household costs – from electricity and gas to groceries and insurance. But taking a little time out could save you big money in the long run.

Simple ways to trim your household costs

Review your regular subscriptions

It’s surprising how many subscriptions you can build up over time – streaming services, gym memberships and more. Consider going through your list every now and then to check you’re still making use of them. If it’s not something you’ve used in the last six months, think about getting rid and saving that cash. And if you miss them, you can usually restart them.

Work to a monthly budget

Take a look at what you’re spending on average each month – both overall and by category, like groceries and cleaning products. Then, you can set a budget you’d like to stick to. Don’t be too strict to start with – you want something that’s challenging but doable. Just having a budget and regularly checking how you’re doing could help focus your mind on spending less.

Keep on top of renewal dates

It’s easy to lose track of when you’re out of your contract with things like broadband, mobile or energy tariffs. But you can end up overpaying if you move on to the standard deal and stay there once your original contract has ended. For car and home insurance, it can be good to shop around with plenty of time before your renewal date. This way, there’s no last-minute rush to find a deal.

Check price comparisons

If you want to see whether you’re paying too much, or you’re serious about switching providers to get a better deal, it’s worth using price comparison sites. You’ll be able to compare quotes across lots of brands at the same time, giving you more choice.

See if you can save on water bills and council tax

For water bills, you can get free water-saving devices from most water companies. Things like regulated shower heads to help you use less water or gel pouches to water your plants less. Or you might be able to save money with a water meter.

With council tax, you can check you’re in the right band, see if you’re eligible for a discount or even ask to spread your payments over 12 months instead of 10.

Ideas for reducing your food bill

We’ve all been stung by the rise in food prices over recent years. But the good news is your grocery bill could be one of the easier ones to tackle. With a little forward-planning and creativity, it’s possible to take a big slice out of your weekly food shop.

Plan your meals at the start of the week

Search ‘meal planning’ online and you’ll find a whole world of info. The NHS website hosts over 60 flexible recipe ideas. There are also many useful apps and online tools that help you make shopping lists, get recipe ideas and create meal plans. The big supermarkets have their own meal planning tools too. Or you can go old school and just use pen and paper.

Campaign group WRAP says the average household throws away £60 of food per month. If you plan your meals so you only buy what you need, that could be a big saving over time.

Choose the right time to shop

Be aware of when your regular supermarket starts reducing what’s on their shelves. If you can hit the store when the ‘reduced to clear’ stickers come out, you can pick up bargains on all sorts of things.

Try swapping big brands for own brand

If you usually buy the well-known brands, try the supermarket’s own-brand items - or even their ‘value’ range. And if you normally go for the premium option, consider trying the less expensive version. If you don’t notice much difference in taste, it may not be worth the difference in price.

Make the most of coupons and vouchers

Keep an eye out for discounts and deals on the things you normally buy. Regularly check for coupons, browse supermarket deals and make the most of their loyalty discounts. If you can get money off something you were going to buy anyway, it’s a no-brainer. Most supermarkets have offers on your first online shop with them so consider taking advantage of these.

Over 5 million customers have already been accepted for a Vanquis Card

Want extra help cutting your costs?

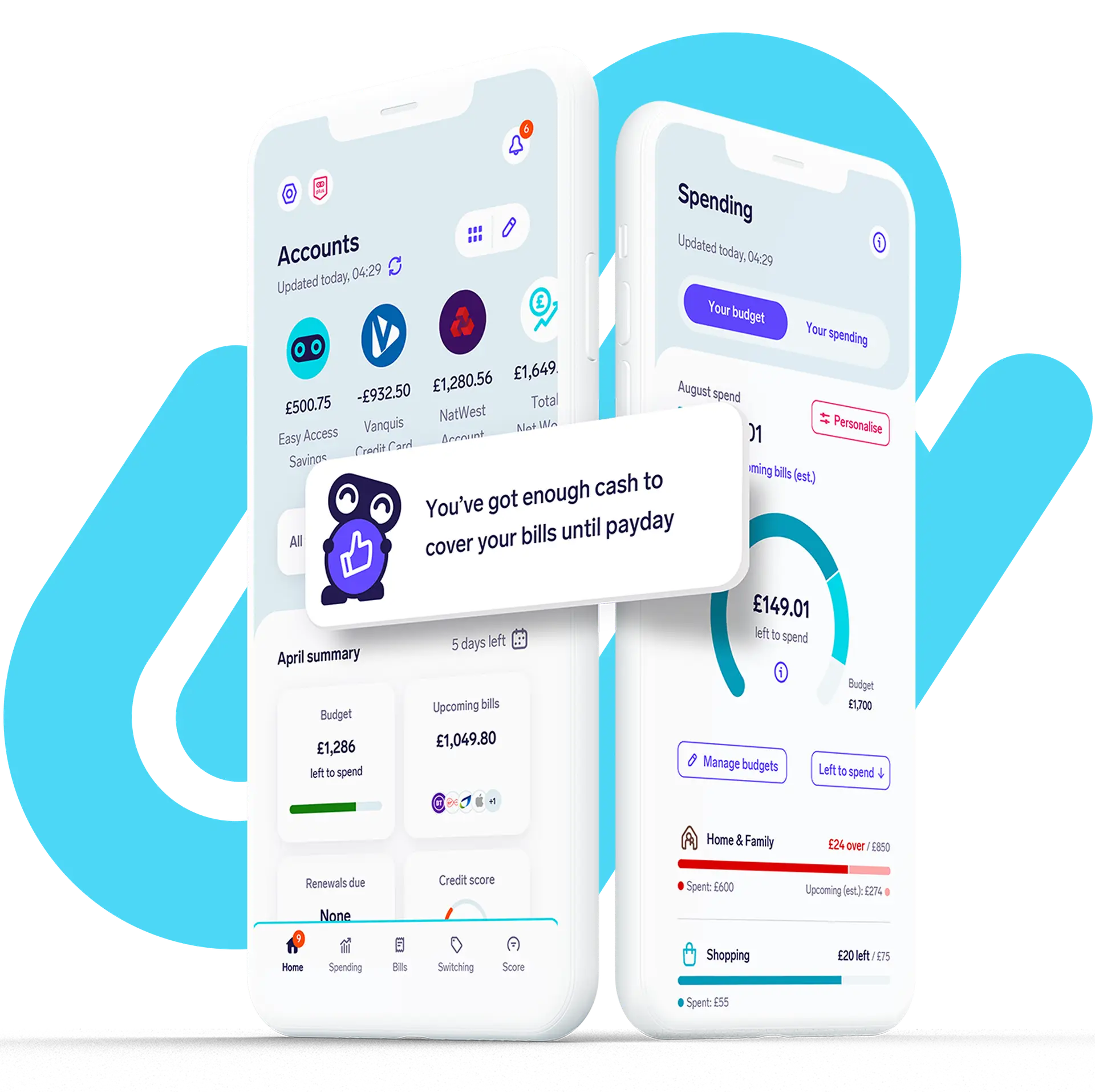

Here’s what you can do with Snoop, the free money-saving app from Vanquis:

- See everything in one app

- Track your spending and set budgets

- Build your credit score

- Cut your bills